Roller Coaster in Mining Industry (Business Cycle)

Imagine we go to the fascinating amusement park. There is a snaking line in a thrill ride, yups it is Roller coaster. I am personally too afraid to play this adrenaline-pumper game, but we all agree that Roller coaster has up and down maneuver, speed, and time period until it ends. It is quite like mining industry behaviour. One day the business is attractive, but in another day the business is possibly sluggish. Then, the managers should cudgel their brain to keep the cash flow positive.

I still remember in 2011, coal price reach its peak. Mining companies gained high profit, operating cost was not a serious concern as long as they were able to extract and sell the coal. In Indonesia, as a result there were a huge number of Mining Permits were released. In total, 2,528 coal Exploration permits and 1,358 Production permits, plus unrecorded illegal mining operation. Moreover, mining engineering student got the job soon after their graduation, even it was normal they worked in mining industry although they had not been graduated. The labor market was pretty hot.

Unfortunately, it was not long last. In 2011, the coal price began to reach its diminishing return and drops to the lowest point afterwards. Next, the coal price increased reluctantly. De Heer and Koller said, the upstream companies, mining industries for instance, show more cyclicality in performance.

Business behaviour not only performs growth in progressive and positive way, but also in slow growth even negativity in its revenue (e.g. mining company in exploration until development phase). The reason why the business possibly goes up and down, mostly because of price instability, the other factors may contribute are policy, demand, or commodity scarcity. Supply- demand factor can be one another significant factor, but the precise reason more than that. This condition is also known as cyclical behaviour.

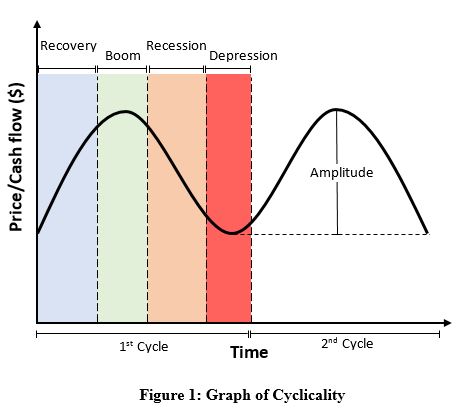

Let me write about what business cycle is, instead of what its cause. Hickernell stated that business cycle fluctuation in price or aggregate volume of production. That uncontrolled up-down behaviour is called cycle. To break it down, basically there 4 phases in one cycle (Hickernell 1922, Schumpeter 1939). First is Boom phase. In Boom phase, at this point the company gain the maximum benefit (e.g. commodity high price or excessive of demand). It can be seen in company revenue. This phase may let the company satisfied by its performance and the company does not care a lot about operating cost and capital cost.

Second is Recession. When the peak has been reached, usually it will not stay long. Soon afterward the graph goes down. The downturn possibly temporary, but sometime it can be the worst. Companies which cannot perform a well-manage corporation will bankrupt soon.

Third is Depression, the company hits rock bottom. In the other words, it is like boom phase in reverse. Nevertheless, after the company stays awhile in bottom line and the company’s manager who is able to handle the situation, the company presents the positive growth, otherwise bankruptcy is another story.

Finally, the phase when company describes a rise is commonly called Recovery. In recovery, some companies may reach the previous highest point. Even, when the company is well-established and stable, the company may achieved the new record.

Figure above illustrates the cyclicality performance. From recovery to Depression is defined as 1 cycle. In real life, every phase may happen short or long term, then in 1 cycle can be done from 3 to 60 years. Also, the amplitude as unpredictable as the length of every phase. Thus, this uncertainty is interesting to discuss.

Moreover, there is also another words describe the business behaviour, it is called volatility. The company which has the up-down phase more unstable may be called its volatility is higher, vice versa. Volatility is expressed as standard deviation. The higher company’s standard deviation, it means the more volatile the company is.

References:

- De Heer, M. and T. M. Koller (2000). "Valuing cyclical companies." Com. Lending Rev. 16: 7.

- Hickernell, W. F. (1922). Business cycles. Boston, American institute of finance.

- Schumpeter, J. A. (1939). Business cycles: a theoretical, historical, and statistical analysis of the capitalist process, McGraw-Hill.

Tentang penulis

Aldin Ardian, ST, MT

Selamat datang di blog saya!!

Saya Aldin Ardian, tenaga pengajar di Prodi Teknik Pertambangan, Fakultas Teknologi Mineral, UPN "Veteran" Yogyakarta. Saya akan mencoba berbagi pengetahuan di dunia maya dengan blog ini sebagai wadahnya.

Blog ini tidak hanya membahas hal serius seputar dunia akademis saja, namun juga hal-hal yang saya alami dan semoga memberikan manfaat bagi pembaca bahkan penulis, dalam hal ini saya sendiri. Saya harap juga seiring waktu, tampilan blog ini akan semakin baik.

Salam Blogging,

Aldin Ardian

Kontak: aldinardian[at]upnyk.ac.id